Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Term Life Insurance: Because Life Happens, Even When You Least Expect It

Protect your loved ones with term life insurance—unexpected moments deserve the best coverage! Learn why it matters today.

Understanding Term Life Insurance: Key Benefits and Considerations

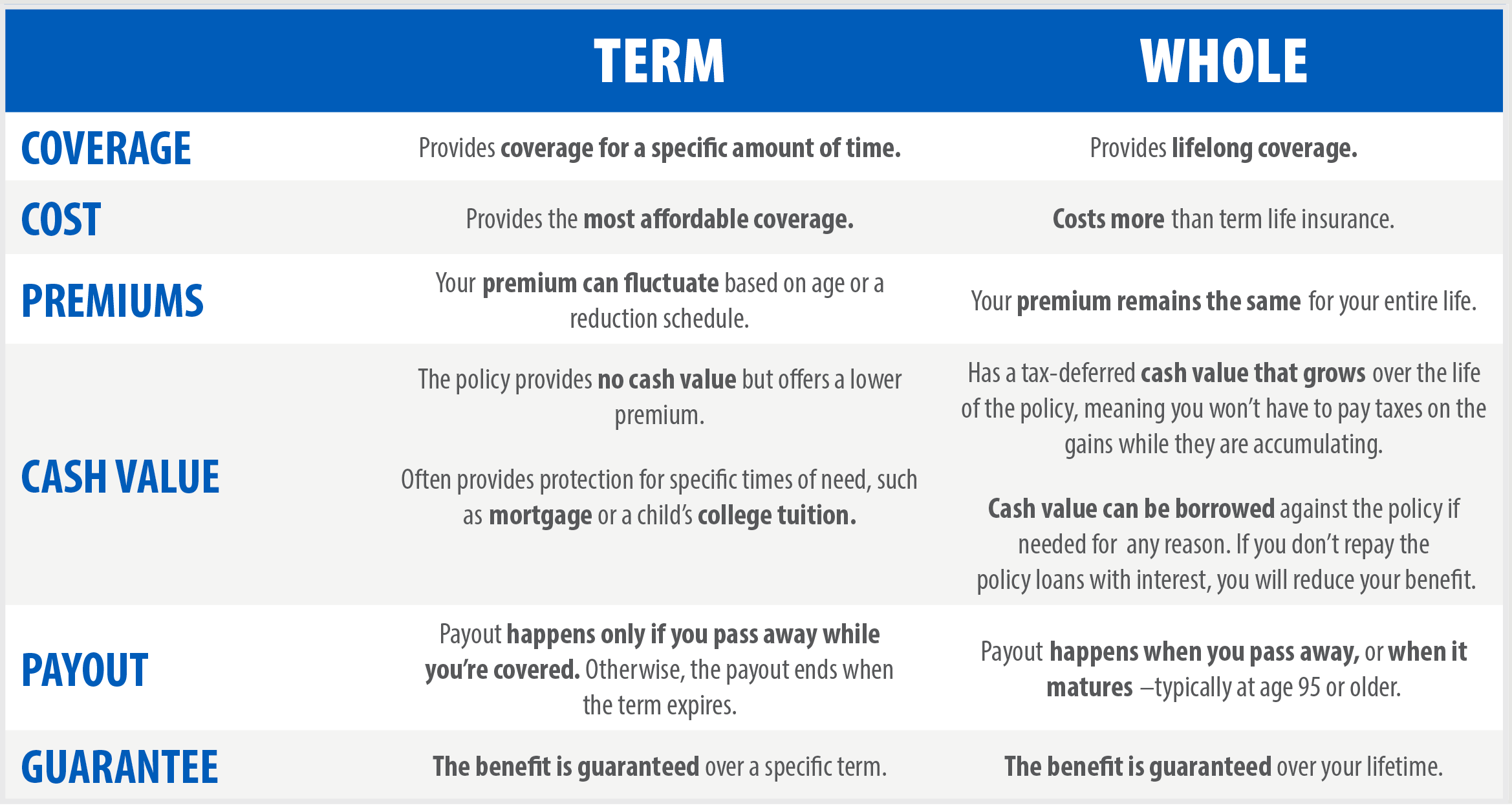

Understanding term life insurance is crucial for anyone considering a financial safety net for their loved ones. It is a type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. One of the key benefits of term life insurance is its affordability, making it an attractive option for young families or individuals who need substantial coverage without the steep premiums associated with permanent life insurance. Moreover, in the unfortunate event of the policyholder's passing during the term, beneficiaries receive a death benefit that can help cover expenses such as mortgage payments, education costs, and daily living expenses.

However, there are important considerations to keep in mind when exploring term life insurance. For instance, once the term expires, the policyholder may either need to renew the policy, often at a higher premium due to age and health status, or find coverage elsewhere. Additionally, unlike permanent life insurance, term policies do not build cash value, meaning they cannot serve as an investment or savings tool. Therefore, it is vital to assess personal financial goals and the potential future needs of dependents when determining whether term life insurance is the right choice for you.

Is Term Life Insurance Right for You? Answering Common Questions

When considering term life insurance, it's essential to evaluate whether it fits your financial needs and life situation. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. This makes it an attractive option for individuals looking to protect their loved ones during critical financial milestones, such as paying off a mortgage or funding a child's education. To determine if this type of insurance is right for you, ask yourself the following questions:

- Do you have dependents who rely on your income?

- What are your long-term financial goals?

- Can you afford the premiums?

Another key factor to consider is your health status and age, as these can significantly impact your eligibility and premium rates. Term life insurance can be a cost-effective solution for younger individuals who are generally healthier and may find lower premium rates. Moreover, if you anticipate changes in your life, such as marriage or having children, securing a term life insurance policy now can provide peace of mind. In the end, evaluating your current and future needs while considering the advantages of term coverage can guide your decision-making process effectively.

How to Choose the Best Term Life Insurance Policy for Your Needs

Choosing the best term life insurance policy for your needs involves considering several key factors. First, assess how much coverage you require based on your financial obligations, such as mortgage payments, children’s education, and other debts. A common guideline is to aim for a policy that is 10-15 times your annual income. Additionally, compare the different lengths of term policies available, typically ranging from 10 to 30 years, to align with your long-term goals. This initial analysis is crucial for ensuring that the policy you select provides adequate protection for your loved ones.

After determining the coverage amount and term length, the next step is to evaluate insurance providers based on their financial stability, customer service ratings, and policy options. Consider obtaining quotes from multiple companies and examining the fine print for exclusions or limitations that may impact your coverage. Don't hesitate to reach out to an insurance agent for personalized advice tailored to your specific situation. By thoroughly researching and comparing various term life insurance policies, you can make an informed decision that will provide peace of mind for you and your family.