Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Quote Quest: Finding Your Best Insurance Match

Uncover the perfect insurance fit for you! Discover tips, tricks, and quotes to secure your peace of mind today.

Understanding Different Types of Insurance: A Comprehensive Guide

Insurance plays a vital role in safeguarding individuals and businesses from unexpected financial burdens. Understanding the different types of insurance available is essential for making informed decisions. The main categories include life insurance, health insurance, auto insurance, and property insurance. Each type serves a unique purpose and caters to specific needs. For instance, life insurance provides financial support to beneficiaries upon the policyholder's demise, while health insurance covers medical expenses incurred during illness or injury.

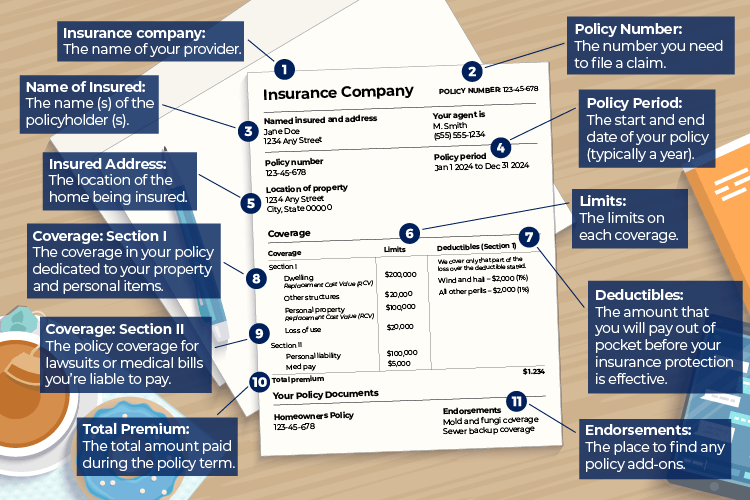

When considering property insurance, it is important to know that it protects your assets from risks like theft, fire, and natural disasters. Similarly, auto insurance helps cover the costs associated with vehicle accidents, including damages to your car and liability for injuries to others. To simplify your understanding, here's a brief overview of these insurance types:

- Life Insurance: Financial security for loved ones.

- Health Insurance: Covers medical treatment expenses.

- Auto Insurance: Protection for vehicles and liability coverage.

- Property Insurance: Safeguards your home and possessions.

5 Essential Questions to Ask When Getting Insurance Quotes

When seeking insurance quotes, asking the right questions can significantly impact your coverage and premiums. Firstly, you should inquire about the type of coverage offered. Are you looking for comprehensive, liability, or perhaps a combination of both? Understanding the nuances of each coverage type can help you select the best policy for your needs. Secondly, don't forget to ask about deductibles. A higher deductible typically means lower premiums, but it's essential to ensure you can afford the deductible should you need to file a claim.

Another vital question to consider is how claims are processed and what the average turnaround time is. Knowing this will help you gauge the insurance provider's efficiency and reliability. Additionally, ask about the discounts available which may apply to your policy. Many insurers provide savings for bundling policies, having a good driving record, or even installing safety devices. Finally, it can be beneficial to understand the insurer's reputation in the market by researching customer reviews and ratings. This knowledge will empower you to make a more informed decision.

The Importance of Comparing Insurance Policies: Finding Your Best Match

When it comes to choosing the right insurance policy, understanding the significance of comparing various options is crucial. Comparing insurance policies allows consumers to assess coverage types, premium costs, and additional benefits that may or may not meet their needs. By taking the time to evaluate several policies, you can spot the differences in coverage details, exclusions, and deductibles that can heavily impact your overall financial protection. This process not only helps in identifying the best match for your current circumstances but also ensures that you are not paying for unnecessary coverage or lacking essential protection.

Moreover, comparing insurance policies fosters informed decision-making and promotes financial savings. Many individuals and families are unaware that similar levels of coverage can vary significantly in price from one insurer to another. By leveraging comparison tools or consulting with independent agents, you can gain insights into not just the cost, but also the insurer's reputation, customer service quality, and claims process efficiency. This holistic approach ensures that you choose not only the most affordable option but one that aligns well with your specific requirements and values, ultimately enhancing your peace of mind.