Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Quote Quest: Finding the Best Insurance Deals

Unlock unbeatable insurance deals! Join the Quote Quest and discover how to save big while finding the perfect coverage for you.

Understanding the Basics: How to Compare Insurance Quotes Effectively

When it comes to comparing insurance quotes, understanding the basics is crucial for making informed decisions. Start by gathering quotes from several insurance providers, ensuring that you are comparing similar coverage types and limits. This will help you avoid discrepancies that may skew your perception of pricing. Use a simple checklist to guide your comparison:

- Premium costs

- Deductibles

- Coverage limits

- Exclusions and limitations

- Customer reviews and ratings

Once you have all the necessary quotes, focus on the specifics that matter most to you. Insurance policies can vary significantly in terms of coverage, so it’s essential to highlight what’s included in each quote. For example, if you're looking at auto insurance, consider factors like roadside assistance, rental car coverage, and personal injury protection. Furthermore, don’t forget to check for any discounts you may qualify for, which can significantly impact your final premium. With all the details at hand, you’ll be well-equipped to make a well-informed decision.

Top 5 Tips for Finding the Best Insurance Deals

Finding the best insurance deals can be a daunting task, but with the right approach, you can save both time and money. Here are top 5 tips to help you navigate the insurance landscape:

- Compare Multiple Quotes: Always gather quotes from various providers. This allows you to see a range of prices and coverage options, ensuring you get the best deal possible.

- Understand Your Needs: Assess what type of insurance you actually need. Tailor your coverage to avoid paying for unnecessary extras.

- Look for Discounts: Many insurance companies offer discounts for bundling policies, having a good driving record, or being a member of certain organizations.

- Read Reviews: Research customer reviews to gauge satisfaction levels. This helps you choose a provider who offers both competitive pricing and reliable service.

- Consult an Insurance Agent: If you’re feeling overwhelmed, consider consulting with an insurance agent. They can provide personalized advice and help you find the best policies to fit your needs.

Common Questions Answered: What You Need to Know About Insurance Quotes

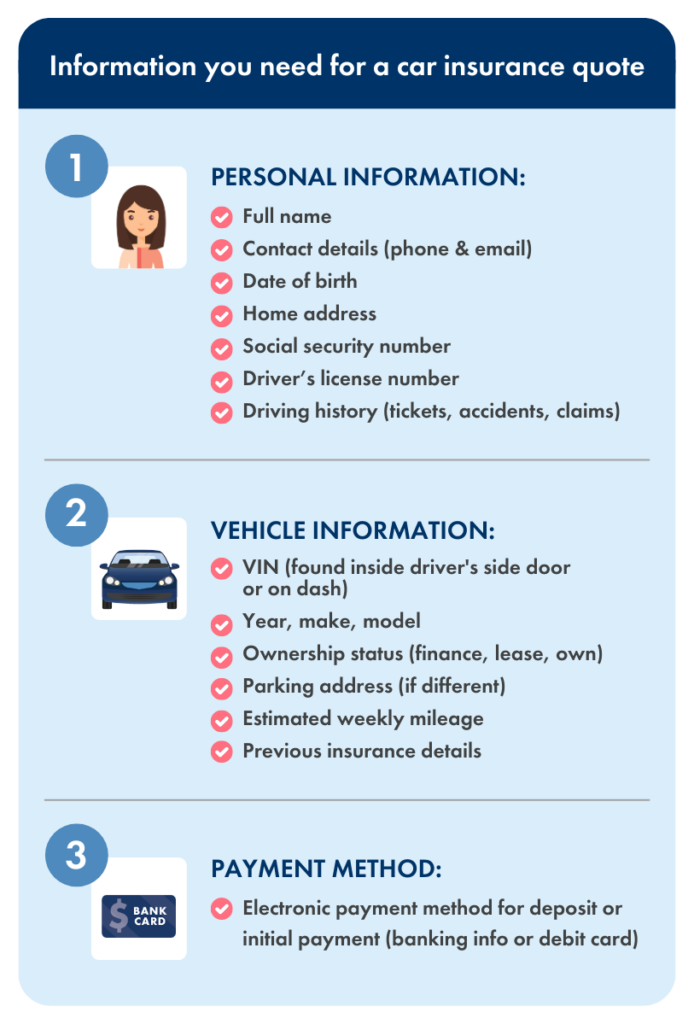

When it comes to obtaining insurance quotes, many people have common questions that need clarification. One of the first things to consider is what factors affect the cost of your insurance. Typically, your insurance quotes will vary based on elements such as your age, location, driving record, and the type of coverage you choose. Additionally, insurance companies may look at your credit history and claims history, so being prepared with this information can help you get a more accurate quote.

Another important aspect to understand is the difference between insurance quotes and insurance policies. A quote is simply an estimate of how much you will pay for coverage, while a policy is a formal agreement that outlines the terms and conditions of your coverage. When comparing quotes, make sure to look at the details offered by different providers, such as deductibles, coverage limits, and any exclusions that may apply. This thorough approach will not only help you find the best price but also ensure you have the right coverage for your needs.