Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

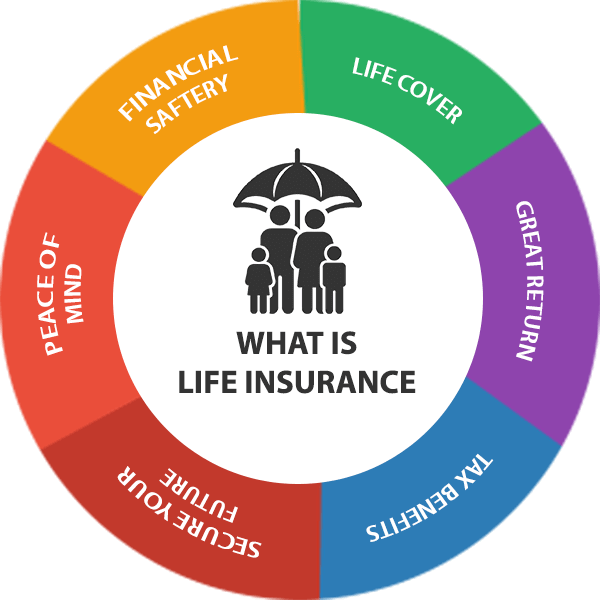

Life Insurance: Your Invisible Safety Net

Discover how life insurance can be your ultimate safety net, protecting your loved ones and securing their future. Don't miss out!

Understanding Life Insurance: What You Need to Know

Understanding life insurance is essential for anyone looking to secure their family's financial future. It provides a safety net that can help alleviate the burdens of unexpected events, such as the loss of a primary breadwinner. Life insurance policies generally fall into two main categories: term life insurance and permanent life insurance. Term life insurance offers coverage for a specific period, usually ranging from 10 to 30 years, while permanent life insurance provides lifelong coverage and includes a cash value component. This makes it crucial to assess your individual needs and financial situation before deciding on the right policy.

When selecting a life insurance policy, consider the following factors:

- Coverage Amount: Determine how much financial support your family would need in your absence.

- Duration: For term life, select a duration that aligns with significant life events, like raising children or paying off a mortgage.

- Premium Costs: Ensure that the premiums fit within your budget without compromising your lifestyle.

- Policy Features: Review additional options, such as riders for critical illness or disability.

Is Life Insurance Worth It? Debunking Common Myths

When it comes to financial planning, life insurance often sparks debate and raises numerous questions. Many individuals hesitate to invest in a policy due to prevalent myths surrounding its value. For instance, some believe that life insurance is only beneficial for those with dependents; however, this is not entirely accurate. Even individuals without children or a spouse can find value in a policy, as it can cover funeral costs or debts, ensuring that loved ones are not burdened during a difficult time. By understanding the true scope of life insurance, one can appreciate its role in a comprehensive financial strategy.

Another common misconception is that life insurance is an unnecessary expense, especially for young, healthy individuals. This perspective misses a crucial factor: locking in lower premiums. Buying life insurance at a younger age can lead to significantly lower rates over the years. Additionally, many policies offer cash value components that can serve as an investment vehicle or savings plan. By dispelling these myths, potential policyholders can make informed decisions that protect their financial future and create peace of mind.

How Life Insurance Acts as Your Family's Financial Safety Net

Life insurance serves as a crucial component in securing your family's financial stability. In the unfortunate event of your passing, your loved ones can be left with significant financial burdens, including mortgage payments, education expenses, and daily living costs. A life insurance policy can provide a lump sum payment, known as the death benefit, which can help cover these expenses and allow your family to maintain their current lifestyle. This financial safety net ensures that your family is not left struggling to make ends meet during a challenging time.

Moreover, life insurance can also be essential for long-term planning. By choosing the right policy, you can create a financial foundation that will support your family's future goals. For instance, the funds can be used to pay for your children's education or contribute to retirement savings for your spouse. As such, life insurance is not just a protection tool; it can also be seen as an investment in your family's future. By securing this safety net, you provide peace of mind, knowing that your loved ones will be protected regardless of what life throws at them.