Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Insurance Showdown: Who's the Best Coverage Champion?

Discover the ultimate insurance showdown! Find out which provider claims the title of best coverage champion and save big on your policy!

Top 5 Factors to Consider When Choosing Insurance Coverage

When selecting the right insurance coverage, it's essential to consider multiple factors that can significantly affect your financial protection.Cost is often the first consideration; compare premiums across different providers to ensure you're getting the best value for your money. Additionally, evaluate the coverage limits to confirm that they meet your specific needs. For example, while a lower premium might seem attractive, it could leave you underinsured in the event of a claim.

Another key factor is the deductible amount, which can influence both your out-of-pocket expenses and premium rates. A higher deductible generally translates to a lower premium, but it also means you will pay more out-of-pocket before your insurance kicks in. Lastly, consider the customer service and claims process of the insurance provider. Researching customer reviews and seeking recommendations can help you select a company with a reputation for excellent service and a smooth claims experience.

Insurance Showdown: Comparing the Best Policies for Your Needs

When it comes to choosing the right insurance policy, assessing your individual needs is crucial. With various types of insurance available—such as health, auto, home, and life insurance—understanding the differences can help you make an informed decision. Start by evaluating your requirements by considering factors like your lifestyle, family situation, and financial obligations. For example, if you have dependents, a comprehensive life insurance plan might be a priority. Conversely, if you’re a first-time homeowner, looking into homeowners insurance that covers natural disasters could save you from significant financial loss.

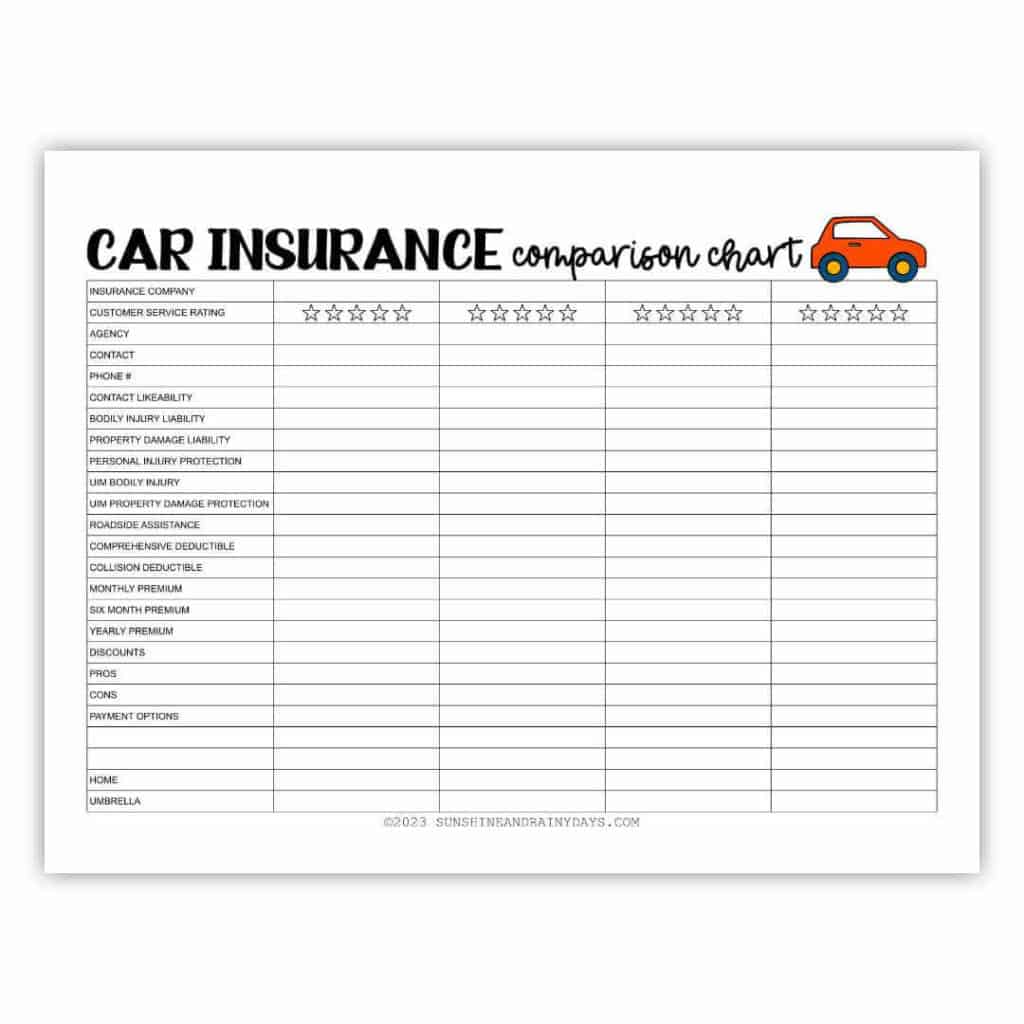

Next, it's vital to compare different insurance policies to find the best fit for your needs. Start by requesting quotes from multiple providers and reviewing the coverage limits, deductibles, and exclusions. Pay close attention to customer reviews and ratings, as they often reveal important insights about the insurance company's claims process and customer service. Create a side-by-side comparison chart to help visualize each policy's benefits. A thorough comparison can reveal hidden gems such as discounts for bundled policies or reward programs, ultimately leading you to the best insurance solution tailored to your circumstances.

What Makes the Best Insurance Coverage? A Comprehensive Guide

When searching for the best insurance coverage, it's essential to evaluate several key factors. First, consider the type of coverage you need, as not all insurance will suit every individual or business. For instance, health insurance typically focuses on medical expenses, while auto insurance is tailored for vehicle-related incidents. Before making a decision, assess the coverage limits, deductibles, and premiums associated with each policy. A comprehensive comparison will help in finding a plan that offers adequate protection without overextending your budget.

Another crucial aspect is the reputation and financial stability of the insurance provider. Checking customer reviews and industry ratings can provide insight into how well a company handles claims and customer service. Additionally, take note of any discounts or bonuses available to policyholders, as these can significantly affect your overall cost. Maintaining a clear understanding of both the benefits and potential limitations of your policy will ensure that you choose the best insurance coverage that meets your unique needs and preferences.