Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

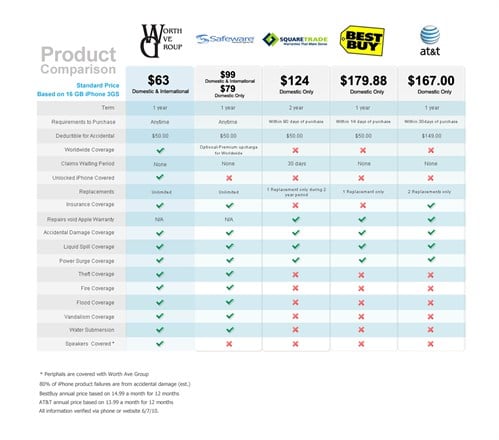

Insurance Face-Off: A Clash of Coverage Titans

Discover the ultimate showdown in Insurance Face-Off! Uncover the best coverage options and find out which titan reigns supreme!

Understanding the Differences: Term vs. Whole Life Insurance

When exploring life insurance options, it’s crucial to understand the fundamental differences between term and whole life insurance. Term insurance offers coverage for a specific period, typically ranging from 10 to 30 years, and is designed to provide financial protection during key life stages such as raising children or paying off a mortgage. One of its main advantages is affordability; since it only covers a set term and does not build cash value, premiums are significantly lower than those of whole life policies.

In contrast, whole life insurance provides coverage for the insured's entire lifetime, as long as the premiums are paid. This type of insurance not only offers a death benefit but also accumulates cash value over time, which policyholders can borrow against or withdraw. The premiums for whole life policies are generally higher, but the stability it provides with fixed payments and lifelong coverage makes it a compelling choice for those looking to ensure long-term financial security for their beneficiaries.

Top 5 Factors to Consider When Choosing Auto Insurance

Choosing the right auto insurance can be a daunting task, especially with the plethora of options available in the market. When evaluating policies, it's crucial to consider coverage options. Most insurance providers offer a range of coverage types including liability, collision, and comprehensive insurance. It's important to assess your driving habits, vehicle value, and personal needs to determine which types of coverage are essential for you. A well-rounded policy will not only protect you financially but also provide peace of mind on the road.

Another vital factor to consider is premium costs. Insurance premiums can vary significantly between providers, so it's wise to shop around and obtain multiple quotes. Pay attention to the deductibles as well—higher deductibles often lead to lower monthly premiums but could mean out-of-pocket costs in the event of a claim. Additionally, look into potential discounts, such as those for safe driving records, bundling policies, or completing defensive driving courses. Taking the time to compare costs and available discounts can save you a substantial amount on your auto insurance.

Health Insurance Mysteries: PPO vs. HMO - Which is Right for You?

Navigating the world of health insurance can be daunting, especially when it comes to understanding the differences between PPO (Preferred Provider Organization) and HMO (Health Maintenance Organization) plans. One of the key distinctions between these options is how they manage care. PPOs provide more flexibility, allowing you to see any doctor or specialist without needing a referral, which can be a significant advantage if you prefer a wider range of providers. However, this convenience often comes at a higher cost, including higher premiums and out-of-pocket expenses.

On the other hand, HMOs generally require you to select a primary care physician (PCP) and obtain referrals to see specialists. This structure is designed to promote coordinated care and often results in lower out-of-pocket costs, making it a budget-friendly option for those who are willing to work within a more limited network. To determine which plan is right for you, consider your health care needs, budget, and whether you prioritize flexibility or cost savings in your health insurance choices.