Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Cheap Insurance: A Wallet-Friendly Way to Stay Protected

Discover wallet-friendly insurance options that won’t break the bank. Protect yourself without the hefty price tag!Get started today!

Understanding the Basics of Affordable Insurance: What You Need to Know

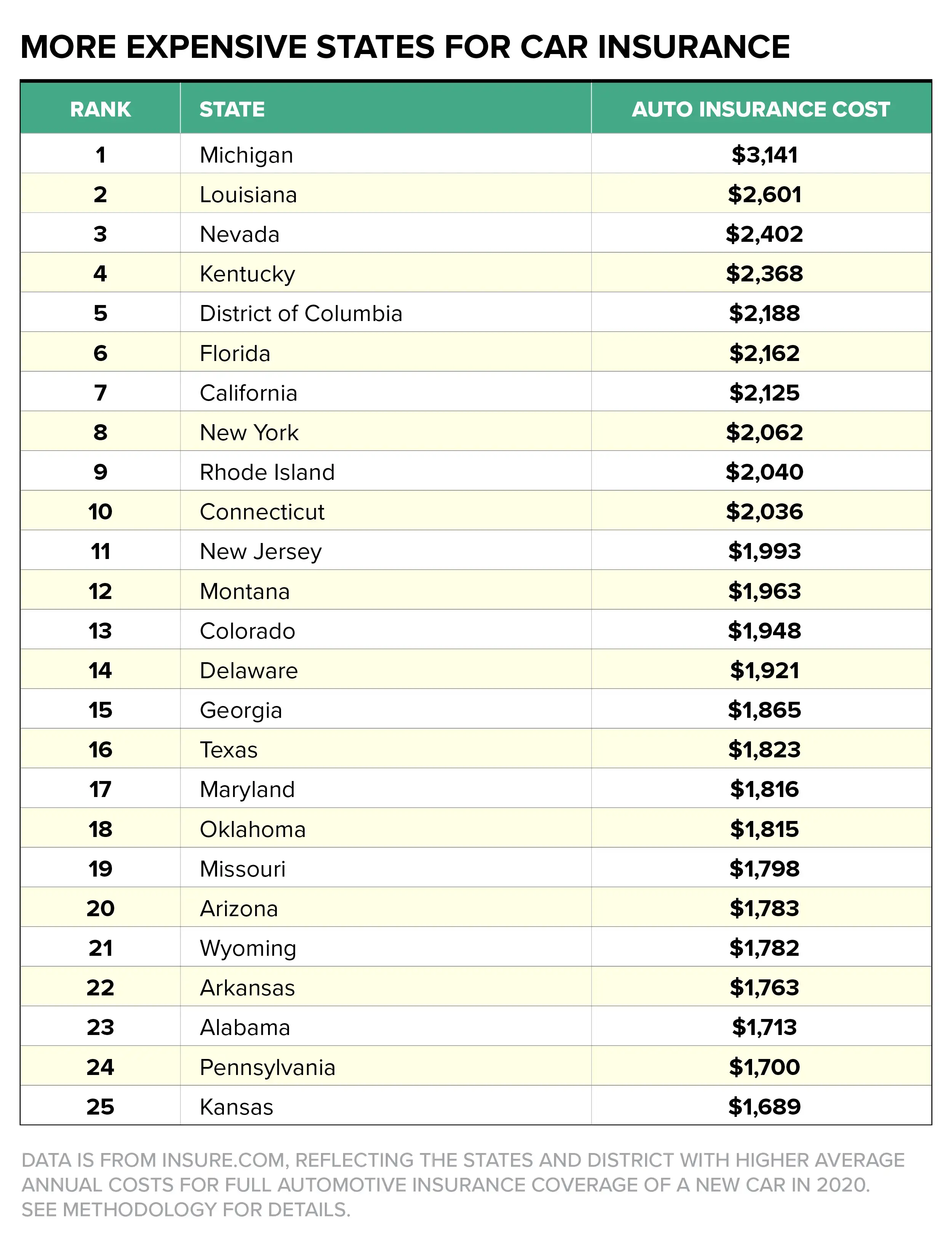

Affordable insurance is an essential aspect of financial planning that helps safeguard both personal and property assets. Understanding the basics of affordable insurance can seem overwhelming, but it becomes more manageable when you break it down into key components. First, it's crucial to understand the different types of insurance available, such as health, auto, home, and life insurance. Each type serves a unique purpose and comes with various coverage options that can influence costs. While considering your options, always evaluate your needs, budget, and the level of coverage that is appropriate for your situation.

When searching for affordable insurance, it is vital to compare multiple providers to find the best rates and coverage. Here are some steps you can follow:

- Assess your specific insurance needs based on factors such as age, health, and assets.

- Research and compare quotes from different insurance companies.

- Check for discounts and bundled policies that can lower your overall premiums.

- Read reviews and ratings for insurance companies to ensure reliability.

By taking the time to understand these fundamentals, you can make informed decisions that ensure you get the coverage you need at a price you can afford.

5 Tips for Finding Cheap Insurance Without Sacrificing Coverage

Finding affordable insurance that meets your needs can be a challenging task. However, by following a few essential tips for finding cheap insurance, you can secure a policy that doesn’t skimp on coverage. First, it’s crucial to compare multiple quotes from various providers. Online comparison tools and insurance brokers can facilitate this process by offering side-by-side evaluations of policies, ensuring you get the best rates available.

Secondly, consider increasing your deductible. A higher deductible typically leads to lower monthly premiums, but be sure you choose an amount you can afford in the event of a claim. Additionally, look for discounts for bundling policies, maintaining a good driving record, or even for being a member of certain organizations. By taking these steps, you can effectively minimize your insurance costs while still maintaining comprehensive coverage.

Is Cheap Insurance Right for You? Answers to Common Questions

When it comes to choosing insurance, many people wonder, 'Is cheap insurance right for you?' It’s essential to consider your specific needs and circumstances before making a decision. Cheap insurance may seem appealing due to its lower premiums, but it might not always provide the coverage you require. Evaluate your situation by asking yourself a few key questions:

- What type of coverage do you need?

- How much risk are you willing to take?

- Can you afford higher deductibles?

Furthermore, understanding the trade-offs associated with cheap insurance is crucial. While it can save money in the short term, cheaper plans often translate to limited coverage. You may find that important services or benefits are not included, leaving you financially vulnerable in case of an accident or disaster. Always read the fine print and compare the coverage options before making a final decision. Remember, the best insurance policy is one that provides peace of mind and adequate protection without overwhelming your budget.