Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Your Wallet's Best Friend: Smart Car Buying Secrets

Unlock savvy car buying tips and save big! Discover secrets that will make your wallet thank you. Drive smarter today!

Top 5 Negotiation Tactics for Getting the Best Deal on Your Next Car

Negotiating for a car can be a daunting task, but with the right tactics, you can secure the best deal possible. Here are Top 5 Negotiation Tactics to consider during your next car purchase:

- Do Your Research: Before stepping on the dealership lot, arm yourself with information about the car's market value, both in trade-ins and purchases. Websites such as Kelley Blue Book provide invaluable data.

- Know Your Budget: Establish your budget beforehand. Having a clear idea of what you can afford will help you stay focused during the negotiation process.

- Be Willing to Walk Away: One of the most powerful tactics is the ability to walk away if the deal doesn’t meet your expectations. This shows the dealer you are serious about your terms.

- Ask Questions: Engaging the dealer with questions can reveal additional information that might tilt the deal in your favor. For example, inquire about any available rebates or financing options.

- Negotiate the Total Price, Not the Monthly Payment: Dealers often focus on monthly payments to make the deal seem more appealing but shifting the conversation to the total price ensures you're getting a better overall deal.

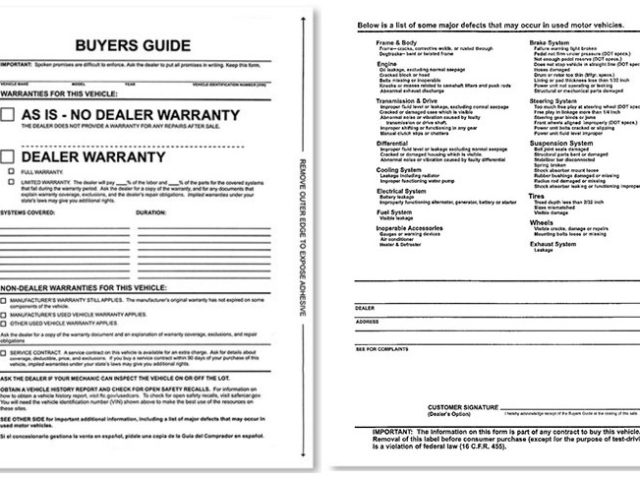

How to Evaluate a Used Car Without Getting Ripped Off

Buying a used car can be a daunting task, especially if you're concerned about getting ripped off. To effectively evaluate a used car, start by conducting thorough research on the specific make and model you're considering. Websites like Kelley Blue Book or Edmunds can provide you with a fair market price. Once you have that information, inspect the vehicle in person. Look for any signs of damage or wear and tear, such as inconsistent paint jobs, rust, or unusual tire wear. A physical inspection gives you a clearer picture of the car's condition and can help you negotiate a better price.

After completing your initial inspection, take the time to check the vehicle history report using the VIN (Vehicle Identification Number). This report can reveal critical information about previous accidents, ownership history, and any significant repairs. Additionally, don't hesitate to take the car for a test drive to assess its performance. Pay attention to the engine's sound, the responsiveness of the brakes, and any unusual vibrations. If you’re uncertain about your evaluation, consider bringing a trusted mechanic to conduct a pre-purchase inspection. This extra step can prevent potential costly surprises and ensure you’re making a well-informed decision when purchasing a used car.

What to Know About Financing Options Before You Buy a Car

Before you make the significant decision to buy a car, it's essential to understand all your financing options. Exploring various methods not only helps you to manage your budget effectively but also allows you to save money over time. Generally, car financing can be categorized into three main types: bank loans, credit union loans, and dealer financing. Each option comes with its own advantages and disadvantages, and deciding which is best for you will depend on factors such as your credit score, the loan term, and current interest rates. Consider using a financing calculator to compare payments across different options and ensure that you can comfortably manage monthly payments.

In addition to the primary financing options mentioned, it's crucial to be aware of other factors that could influence your final decision. For example, down payments can significantly impact your loan terms; a larger down payment can help lower your interest rates and monthly obligations. Additionally, pre-approval for a loan can streamline the buying process and give you a clearer picture of your budget when you start shopping for your vehicle. Lastly, always read the fine print and lookout for additional fees, such as origination fees, that could affect the total amount you'll end up paying for your car. By being informed and diligent, you can secure a financing option that aligns with your financial situation.