Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

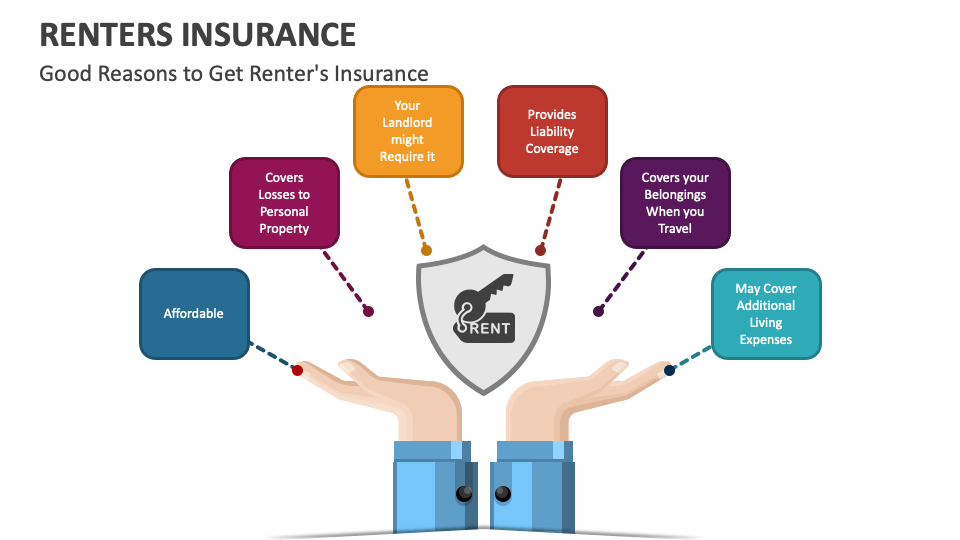

Why Renters Insurance is Your Best Friend in a Crisis

Discover why renters insurance is your ultimate safety net in crises—protect your home and peace of mind with just a few clicks!

Understanding Renters Insurance: How it Protects You in a Crisis

Renters insurance is a crucial form of protection for tenants, covering personal property against risks such as theft, fire, or water damage. In a crisis, it provides financial support to replace your belongings, ensuring that you are not left in a lurch. Many people believe that their landlord's insurance covers their personal items; however, this is a common misconception. It's important to understand that in the event of a disaster, you are responsible for your belongings, and without renters insurance, you could face significant out-of-pocket expenses.

In addition to protecting your property, renters insurance often provides liability coverage as well. This means that if someone is injured in your rented space, your policy could help cover legal expenses or medical bills related to the incident. To summarize, investing in renters insurance not only safeguards your belongings but also offers peace of mind, knowing that you have a financial safety net in case of emergencies. By giving yourself this layer of protection, you can navigate life's uncertainties with greater confidence.

Top 5 Situations Where Renters Insurance Can Be a Lifesaver

Renters insurance can be a true lifesaver in various scenarios that many tenants might not initially consider. One of the top situations is when there's a sudden fire in the apartment building. Even if your unit escapes the flames, the smoke damage can be severe. With renters insurance, you can claim damages for personal belongings like clothing, electronics, and furniture, which can help you recover quickly in such an unfortunate event.

Another crucial situation involves theft. If someone breaks into your apartment and steals your possessions, the financial burden of replacing those items can be overwhelming. Fortunately, having renters insurance means you can file a claim to recover the value of lost items, which can range from small electronics to more valuable heirlooms. In addition, many policies also cover theft that occurs outside your home—like if your belongings are stolen from your car.

Is Renters Insurance Worth It? Exploring Its Benefits in Emergencies

When considering whether renters insurance is worth the investment, it's essential to understand the myriad of benefits it offers, especially in emergencies. This type of insurance protects your personal belongings against unexpected events such as fire, theft, or vandalism. In a scenario where your belongings suffer damage or loss, having renters insurance can provide financial relief by covering the cost of repairs or replacements. Additionally, many policies include liability coverage, shielding you from potential lawsuits if someone is injured while on your property, further adding to its value during unforeseen incidents.

Those who underestimate the importance of renters insurance often find themselves unprepared when emergencies strike. For instance, if a natural disaster damages your apartment, without insurance, you could face substantial out-of-pocket costs for replacing essential items. Many renters may be surprised to learn that the coverage typically extends beyond just damage to personal property; it may also cover temporary housing expenses if you're displaced due to an emergency. In essence, renters insurance acts as a safety net, ensuring that you have the resources you need to recover quickly and effectively during challenging times.