Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Term Life Insurance: Because Living Your Best Life Shouldn't Break the Bank

Discover affordable term life insurance options that protect your loved ones and keep your finances on track. Live your best life without the stress!

Understanding the Basics: What is Term Life Insurance and How Does It Work?

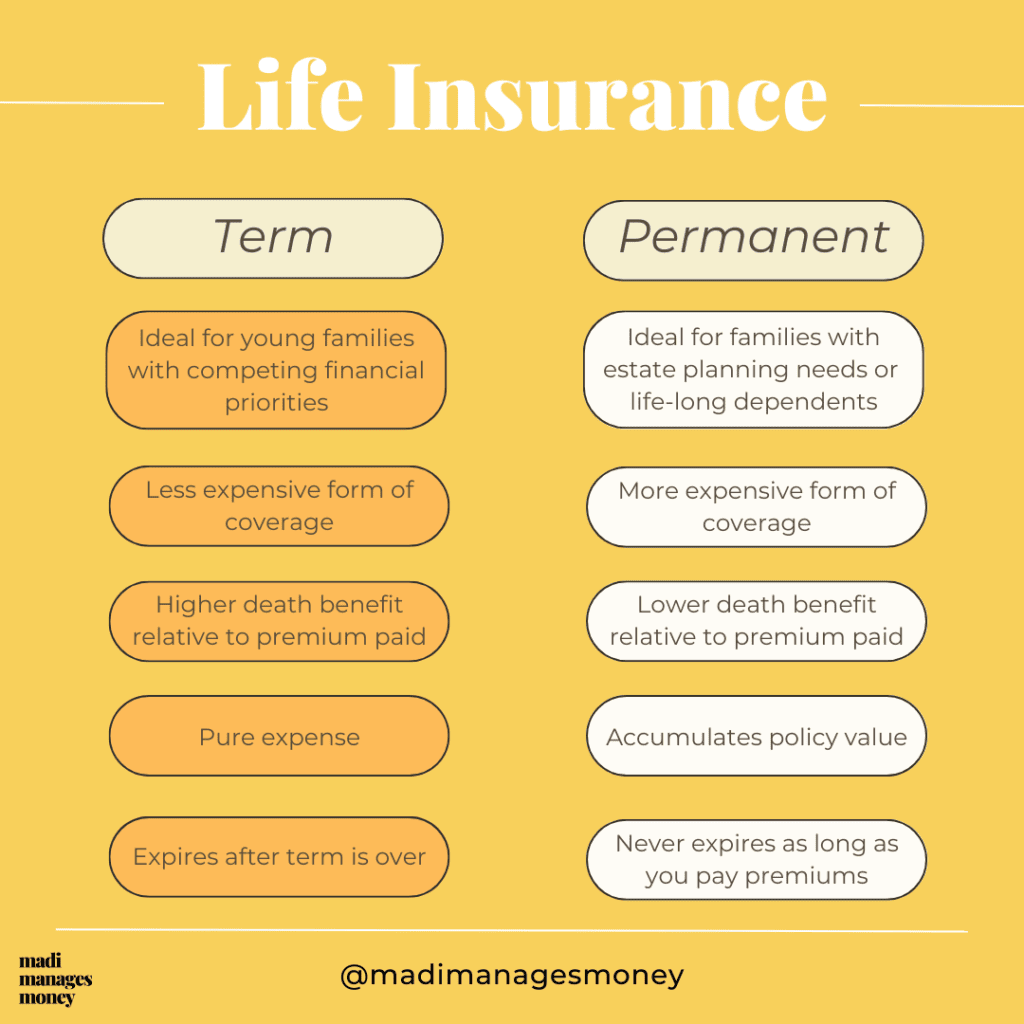

Term life insurance is a type of life insurance policy that provides coverage for a specific period, or 'term,' typically ranging from 10 to 30 years. Unlike whole life insurance, which offers lifetime coverage and can accumulate cash value, term life insurance focuses solely on providing a death benefit to your beneficiaries if you pass away during the term of the policy. Because of this straightforward structure, term life insurance is usually more affordable than other types of life insurance, making it an attractive option for individuals looking to secure financial protection for their loved ones during critical years, such as while raising children or paying off a mortgage.

The operation of term life insurance is relatively simple. When you purchase a policy, you agree to pay a premium—usually on a monthly or annual basis—in exchange for a predetermined death benefit. If you die within the term, your beneficiaries receive the full death benefit, which can be used to cover expenses like funeral costs, outstanding debts, or living expenses. However, if you outlive the term of the policy, the coverage expires, and you may have the option to renew or convert the policy to a permanent life insurance policy, often at a higher premium. This feature adds a layer of flexibility while still keeping the focus on providing essential financial support during a specified time frame.

5 Key Benefits of Term Life Insurance That Can Save You Money

Term life insurance is a smart financial planning tool that can offer significant savings while providing essential protection for your loved ones. One of the primary benefits is its affordability; term life insurance typically comes at a lower premium compared to whole life or universal life policies. This allows policyholders to secure higher coverage amounts without straining their budgets. Additionally, term life insurance can be tailored to match your specific needs, providing coverage for a predetermined number of years, which means you only pay for what you need.

Another key advantage of term life insurance is its simplicity and transparency. Unlike other types of life insurance, which can involve complex cash value components, term policies are straightforward. Premiums remain consistent throughout the policy term, making it easier for you to budget and manage your finances. Moreover, if you need to renew your policy after the term ends, you may have the option to do so without having to prove insurability, ensuring continued protection for your family even as circumstances change.

Is Term Life Insurance Right for You? 10 Questions to Consider

Deciding whether term life insurance is right for you involves careful consideration of several key factors. First and foremost, assess your financial responsibilities and dependents. For instance, do you have children, a spouse, or elderly parents who rely on your income? If the answer is yes, a term life insurance policy can provide crucial financial support in the event of your untimely passing. Additionally, consider your current debts, such as a mortgage or student loans, as these obligations can also weigh heavily on your loved ones if they are left unpaid.

Next, ask yourself about your long-term financial goals.

- Are you saving for retirement or your children's education?

- What lifestyle do you envision for your family in the future?

- Can you afford the premiums?