Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Stock Market Shenanigans That Could Make You Rich or Leave You Broke

Uncover wild stock market secrets that could skyrocket your wealth or wipe you out—dare to dive in and find out!

5 Stock Market Myths That Could Cost You a Fortune

The stock market is often surrounded by various myths that can mislead investors and potentially cost them a fortune. One prevalent myth is that you need to be wealthy to invest in stocks. This misconception can deter new investors from participating in the market. In reality, many platforms allow for fractional share investing, meaning you can buy a portion of a share for a small amount of money. Additionally, with the rise of robo-advisors and low-cost trading platforms, anyone can start investing with minimal upfront capital.

Another damaging myth is the belief that you must time the market perfectly to make money. Market timing involves predicting future price movements, which is notoriously difficult even for seasoned investors. Instead of trying to time the market, a more effective strategy is to adopt a consistent investment approach, such as dollar-cost averaging, where you invest a fixed amount regularly regardless of market conditions. This strategy not only reduces the impact of volatility but also helps in building a robust investment portfolio over time.

Are You Falling for These Common Investment Traps?

Investing can be a complex landscape, and many individuals find themselves falling for common investment traps that can derail their financial goals. One prevalent pitfall is chasing past performance. Investors often gravitate towards stocks or funds that have recently shown significant gains, assuming that high returns will continue indefinitely. This behavior can lead to buying at inflated prices and subsequently facing losses as the market corrects itself.

Another significant trap is the fear of missing out (FOMO), which causes investors to jump into trends or popular investments without thorough research. This rush can result in poorly-timed decisions and a lack of diversification in their portfolio. To avoid these traps, it is crucial to establish a clear investment strategy based on thorough analysis and long-term goals, rather than emotional reactions to market fluctuations.

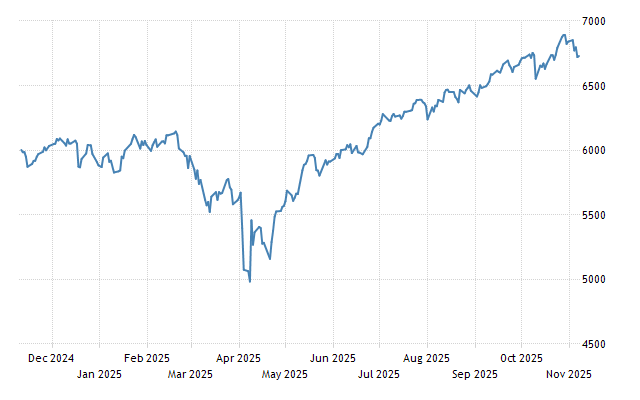

The Ultimate Guide to Navigating Stock Market Volatility

Understanding how to navigate stock market volatility is crucial for both seasoned investors and those new to the trading world. Market fluctuations, characterized by rapid price changes, can be influenced by a myriad of factors such as economic indicators, geopolitical events, and changes in investor sentiment. To effectively manage these unpredictable swings, it is essential to develop a robust strategy that includes diversification, risk management, and a clear understanding of your investment goals.

One effective approach to handle stock market volatility is to maintain a long-term perspective. Instead of reacting impulsively to short-term market changes, consider focusing on the overall trend of your investments. Here are key tips to help you stay the course:

- Stay Educated: Continuously learn about market principles and economic factors.

- Set Realistic Goals: Define your financial objectives and risk tolerance.

- Rebalance Your Portfolio: Regularly assess your investments to ensure they align with your strategy.