Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Pet Insurance: Because Vets Don't Accept IOUs

Protect your furry friend from surprise vet bills! Discover why pet insurance is a smart choice for every pet owner today!

Understanding Pet Insurance: What You Need to Know Before You Buy

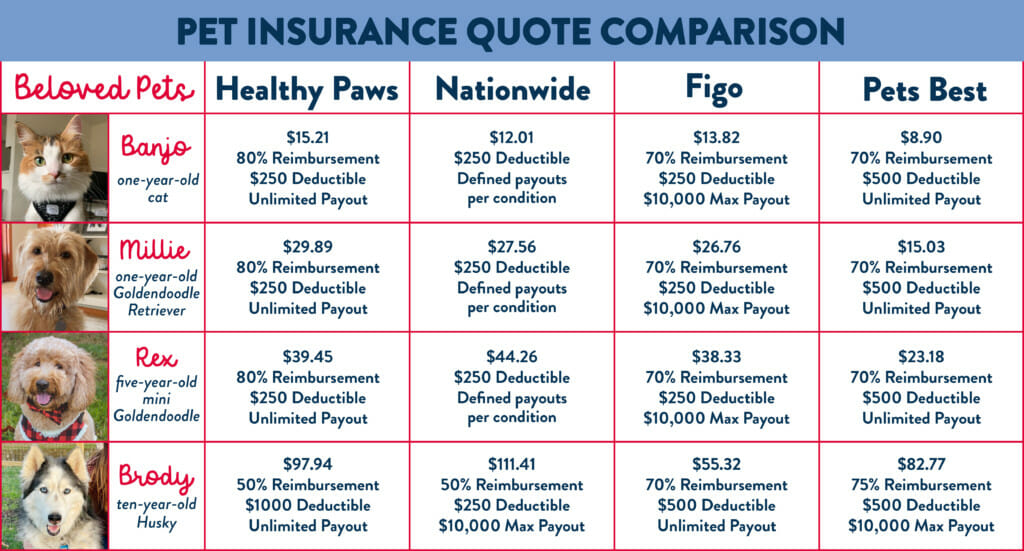

Understanding pet insurance can be a daunting task for many pet owners. With various plans available, it's essential to comprehend the specifics of what each policy covers and the associated costs. Before you make a purchase, consider factors such as your pet's age, breed, and pre-existing health conditions, as these can significantly impact your options. Additionally, familiarize yourself with common terms like deductibles, co-pays, and coverage limits to ensure you are making an informed decision.

When evaluating pet insurance plans, remember to take into account the network of veterinarians available under each policy. Some plans may require you to visit specific providers, while others offer more flexibility. It is also wise to read reviews and testimonials from existing policyholders to gain insight into their experiences. By conducting thorough research and asking the right questions, you can find a reliable pet insurance policy that fits your pet's unique needs and provides peace of mind for you as an owner.

Top 5 Reasons Why Pet Insurance is Essential for Pet Owners

As a pet owner, ensuring the health and well-being of your furry companion is a top priority. Pet insurance is essential for several reasons. Firstly, it provides financial protection in case of unexpected veterinary expenses. Pet emergencies can arise at any moment, and the costs can quickly add up. With pet insurance, you can easily manage these expenses, allowing you to focus on what truly matters – your pet's recovery.

Secondly, pet insurance often covers a range of treatments and services, from routine check-ups to surgeries and even emergency care. This comprehensive coverage allows for peace of mind, knowing that you can provide the best care for your pet without the burden of exorbitant costs. As veterinary medicine advances, the treatments available become more sophisticated and, consequently, more expensive. By investing in pet insurance, you're ensuring that your beloved pet receives the highest standard of care when they need it most.

Is Pet Insurance Worth It? Answers to Your Most Common Questions

When considering whether pet insurance is worth it, many pet owners grapple with the potential costs versus the benefits. On one hand, pet insurance can provide peace of mind by covering unexpected veterinary expenses, especially in emergencies. A single visit to the vet for an emergency procedure can sometimes reach thousands of dollars, making the investment in pet insurance seem more appealing. However, it’s important to read the fine print and understand what is covered under your specific policy, as some pre-existing conditions may not be included.

Another aspect to consider is the long-term savings that can result from having pet insurance. While there are monthly premiums to pay, many pet owners find that the cost is offset by the savings on large veterinary bills, particularly for serious illnesses or injuries. Additionally, insurance policies often come with benefits such as wellness checks, vaccinations, and preventive care coverage. Ultimately, deciding if pet insurance is worth it depends on your individual circumstances, including your pet's health, breed, and your financial situation. Making an informed choice can lead to a safer, healthier future for your beloved pet.