Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Insurance Showdown: Finding Your Perfect Match

Discover the ultimate guide to choosing the best insurance! Uncover tips and tricks to find your perfect match in our thrilling showdown!

Understanding the Different Types of Insurance: Which is Right for You?

When it comes to protecting your assets and securing your financial future, understanding the different types of insurance is crucial. Insurance can be broadly categorized into several types, each serving a specific purpose. Common types include health insurance, which covers medical expenses; auto insurance, which protects against vehicle-related incidents; homeowners insurance, which safeguards your property; and life insurance, which provides financial support to your beneficiaries in the event of your passing. Knowing the key features of each can help you make informed decisions about which policies suit your needs.

To determine which type of insurance is right for you, consider your unique circumstances, lifestyle, and financial goals. Start by evaluating your current situation:

- Assess your assets: What do you need to protect?

- Evaluate your risks: What are the potential threats to those assets?

- Understand your budget: How much can you afford to spend on premiums?

Top 5 Factors to Consider When Choosing an Insurance Policy

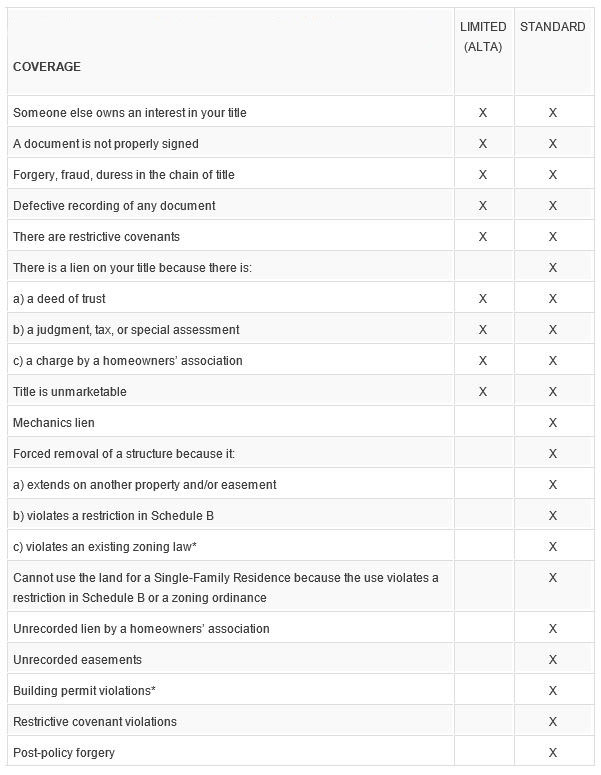

When selecting an insurance policy, coverage options should be at the forefront of your decision-making process. It's essential to assess the type of protection you need based on your individual circumstances, whether it's health, auto, home, or life insurance. A well-rounded policy should clearly outline what is included, thus avoiding potential coverage gaps. Additionally, you should consider any specific endorsements or riders that can customize your policy to better meet your needs, providing extra peace of mind.

Another crucial factor to consider is the premium cost. While it may be tempting to choose a policy solely based on a lower premium, it's important to evaluate how that cost impacts your overall coverage. Always look for a balance between affordability and adequate protection. Be sure to obtain multiple quotes and understand the different pricing structures, as discounts and payment plans can significantly affect the total cost over time.

Insurance Showdown: FAQs About Finding Your Perfect Match

Choosing the right insurance can feel overwhelming, especially with the myriad of options available in the market today. To simplify your search, start by asking yourself a few key questions: What coverage do I need?, How much can I afford?, and Are there specific providers I prefer? These FAQs can help narrow down your choices and lead you to the ideal policy. Remember, comparing quotes from different insurers can significantly impact your decision, ensuring you get the best deal without compromising on coverage.

Another common inquiry is about understanding the fine print. Take the time to read through the terms and conditions to avoid any surprises down the line. You might also want to ask about available discounts, as many insurance companies offer them for bundles or long-term customers. Ultimately, the aim is to find an insurance plan that offers not just the best rate but also the most comprehensive coverage tailored to your unique needs. By addressing these important FAQs, you are one step closer to finding your perfect insurance match.