Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Insurance Showdown: Finding the Best Coverage Without Losing Your Mind

Uncover the secrets to choosing the perfect insurance! Navigate coverage options effortlessly and save your sanity in our ultimate showdown.

The Ultimate Guide to Navigating Insurance Options: Tips for Stress-Free Coverage

Navigating insurance options can often feel overwhelming, but with the right approach, you can simplify the process. Start by assessing your needs—consider what types of coverage you require, whether it's health, auto, or home insurance. Once you've identified your needs, create a checklist of questions to ask potential providers. For example:

- What is the coverage limit?

- Are there any exclusions?

- What is the deductible?

This method ensures that you are thoroughly informed and can make a decision that best suits your lifestyle and budget.

Another essential tip for achieving stress-free coverage is to compare multiple insurance providers. Utilize online comparison tools to evaluate different policies side by side. Pay close attention to the fine print; understanding the terms and conditions can save you from unexpected surprises later. Additionally, consider seeking guidance from an independent insurance agent who can help clarify complicated jargon and offer tailored advice. Remember, your peace of mind is paramount—prioritize finding a provider who not only offers competitive rates but also excellent customer service.

5 Common Insurance Myths Debunked: What You Really Need to Know

When it comes to insurance, misconceptions can lead people to make unwise decisions regarding their coverage. One common myth is that young, healthy individuals don’t need insurance. However, unexpected events can occur at any age, making it essential to consider a policy. Another prevalent misconception is that all insurance policies are the same. In reality, policies can vary significantly in terms of coverage, exclusions, and premiums, which is why it's crucial to read the fine print and understand what you are purchasing.

Another myth is that your credit score doesn’t affect your insurance premiums. In fact, many insurance companies use credit scores as part of their underwriting process, meaning a lower score could result in higher rates. Additionally, people often believe that insurance is only necessary for expensive items, but in truth, even items of modest value or personal liability can warrant coverage. Understanding these myths can help you make informed decisions about your insurance needs.

How to Compare Insurance Policies: A Step-by-Step Approach to Finding the Best Fit

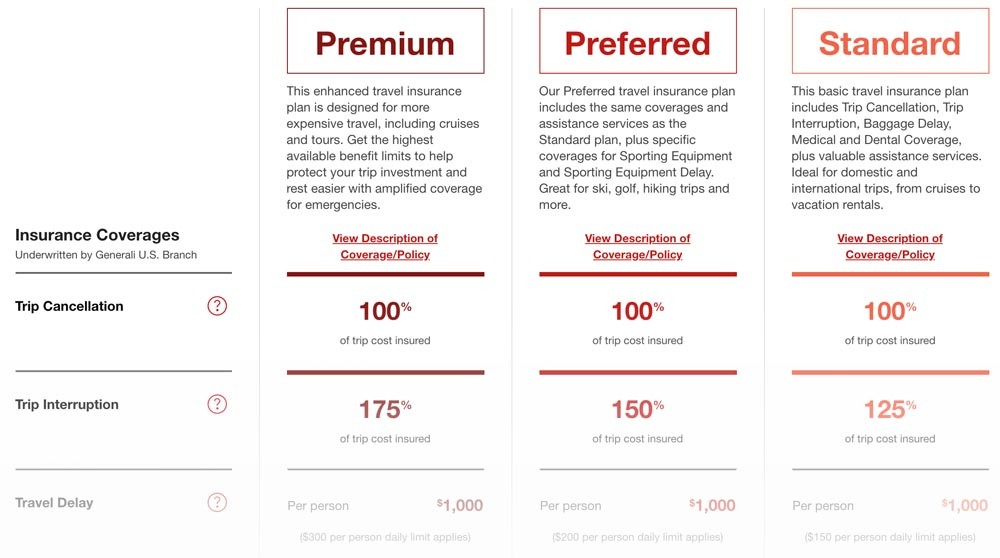

Comparing insurance policies can seem overwhelming, but breaking it down into manageable steps can simplify the process. Start by identifying your needs; consider what coverage is essential for you and your family. Whether it’s health, auto, or home insurance, make a list of the specific requirements you want the policy to fulfill. Next, gather quotes from multiple providers. This allows you to see a range of prices and coverage options, making it easier to spot the best deals. It’s also crucial to examine the policy details closely, as the lowest premium may not always be the best option if it lacks critical coverage.

Once you've collected the quotes, compare the coverage limits and specific terms of each policy side by side. Create a comparison chart that outlines key features such as deductibles, premiums, and exclusions. This will help you visualize the differences and assess which policy offers the most value. Additionally, consider reading reviews or seeking recommendations to gauge customer satisfaction with a provider's claims process and service quality. Remember, an informed decision stems from understanding your options, so take the time to analyze each policy carefully. Following these steps ensures that you find an insurance policy that not only meets your needs but also provides peace of mind.