Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Insurance Quotes: The Unexpected Game Changer You Didn't Know You Needed

Unlock savings and surprises with insurance quotes—discover the game changer that could transform your financial future!

Top 5 Reasons Why Comparing Insurance Quotes Can Save You Money

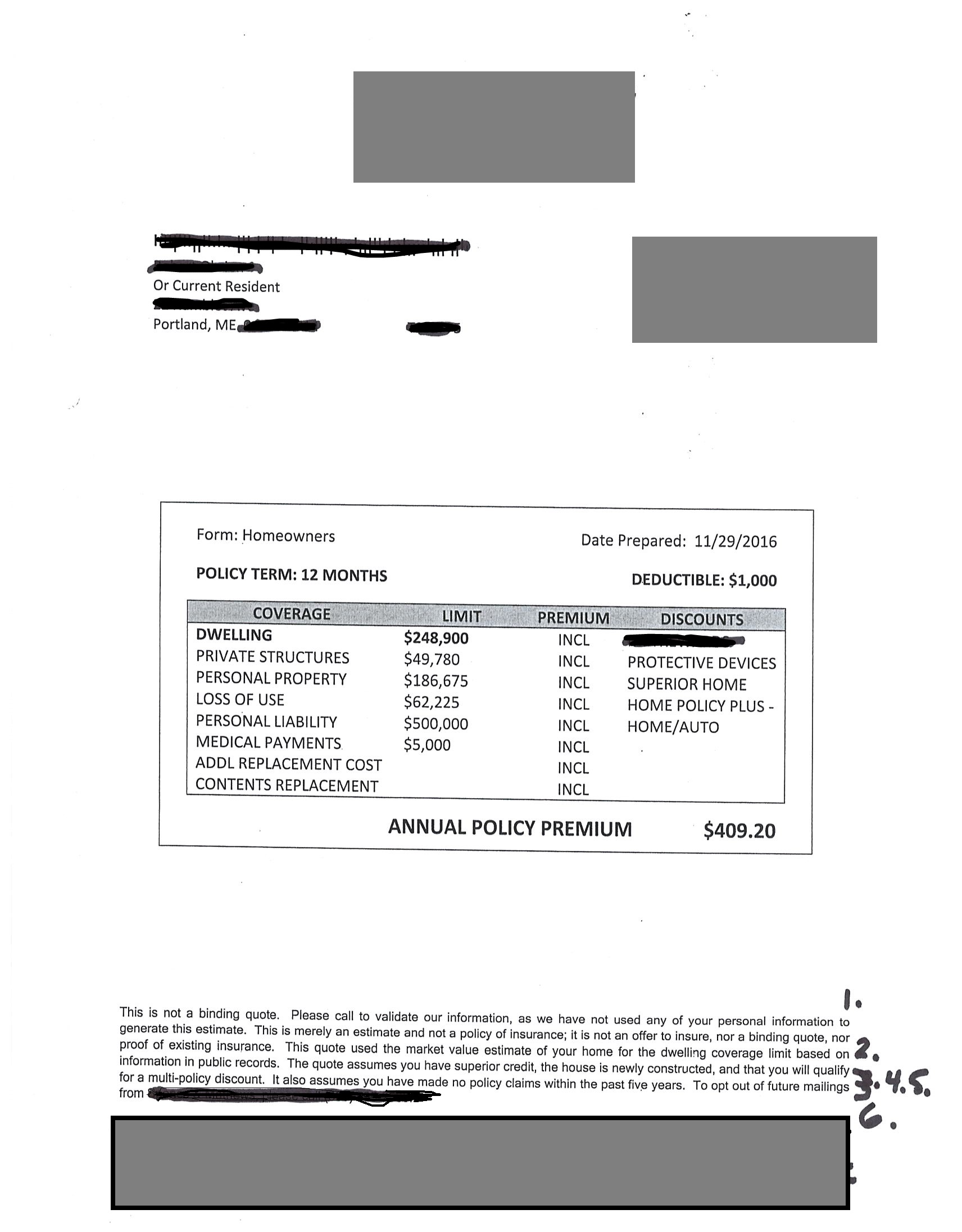

When it comes to managing your finances, one of the smartest moves you can make is to compare insurance quotes. Shopping around for the best rates can lead to significant savings, as premiums can vary widely among different providers for the same coverage. In fact, by taking the time to assess multiple options, you’re empowered to make informed decisions that align with both your needs and budget. Additionally, comparing quotes allows you to identify any hidden fees or discounts that may be available to you, ultimately ensuring that you receive the best deal possible.

Another reason to compare insurance quotes is the opportunity to gauge the quality of coverage offered by different companies. Not all insurance providers are created equal; some may offer extensive benefits and superior customer service, while others might focus primarily on cost. By evaluating policies side-by-side, you can better understand the nuances of coverage and select a plan that not only saves you money but also provides adequate protection. Remember, affordability shouldn’t come at the expense of quality; thus, making well-informed choices is crucial in the insurance marketplace.

Insurance Quotes Demystified: How to Find the Best Coverage for Your Needs

Finding the right insurance quotes can often feel like a daunting task, especially with the myriad options available in the market. To simplify this process, it is essential to start by identifying your specific needs—whether it's auto, home, health, or life insurance. By determining the level of coverage you require and any additional features that might be beneficial, such as lower deductibles or particular policy riders, you can streamline your search. Additionally, utilizing online comparison tools can help you access multiple quotes in one place, allowing you to compare prices and coverage efficiently.

Once you have gathered several insurance quotes, it's time to analyze them carefully. Look beyond the premium amounts; assess factors like deductibles, coverage limits, and any exclusions or limitations that may apply. A quote that initially seems low may lack essential coverage or have higher out-of-pocket expenses. Furthermore, don’t hesitate to reach out to agents or brokers for clarification on specific terms or to negotiate your options. By taking a methodical approach, you can demystify the insurance quote process and make an informed decision that best fits your financial and coverage needs.

Are You Overpaying for Insurance? Find Out with These Simple Steps

Are you unsure whether you're overpaying for insurance? You're not alone; many individuals unknowingly spend more than necessary on their insurance plans. To determine if you're getting the best deal, start by reviewing your current policies. Look through the coverage options and limits, and assess whether they still meet your needs. Next, compare quotes from different insurance providers. Utilize online comparison tools that allow you to see the costs and coverage side by side. This will give you a clearer picture of where you stand.

Once you've gathered information, consider following these simple steps:

- Evaluate Your Needs: Reflect on the actual coverage you require based on your lifestyle or assets.

- Review Discounts: Check for any discounts offered by your current insurer or potential new ones.

- Consult an Agent: A qualified insurance agent can help navigate complexities and might uncover savings opportunities.