Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Gold Rush 2.0: Why Today’s Traders Are Digging Deep

Discover the secrets of today's trading gold rush and learn why savvy traders are striking it rich in the digital market!

Exploring the New Frontier: What Drives Today's Gold Rush in Trading?

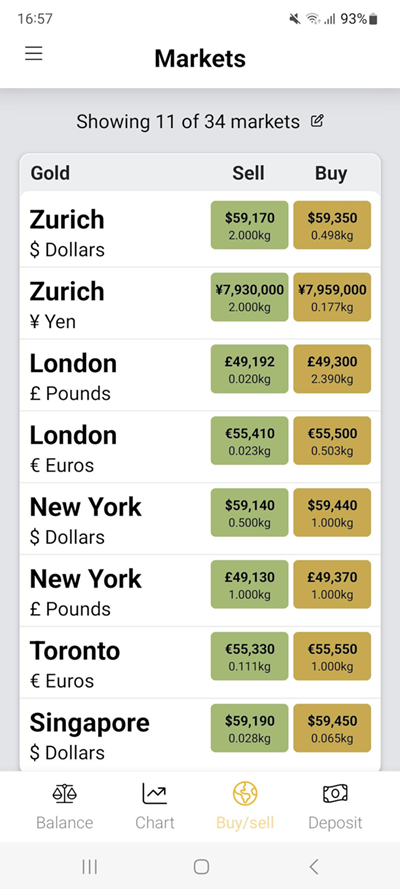

The modern landscape of trading has evolved into a dynamic gold rush, fueled by a combination of technological advancements, collective trading behavior, and the democratization of information. With the rise of online trading platforms, individuals now have unprecedented access to financial markets that were once the exclusive realm of institutional investors. This newfound accessibility, paired with innovative tools like mobile trading apps and algorithmic trading, has transformed novice traders into active market participants, eager to capitalize on volatility and emerging opportunities.

Moreover, social media and online communities play a pivotal role in shaping trading trends, as the collective intelligence of traders drives significant price movements. Platforms like Reddit and Twitter facilitate discussions that can influence stock prices within hours, making it essential for traders to stay informed and engaged. The interplay of sentiment and market dynamics creates a thrilling yet unpredictable environment, akin to the historical gold rushes, making it imperative for today’s traders to adopt agile strategies and remain vigilant in this ever-changing frontier.

Top Strategies for Success in Gold Rush 2.0: Insights from Experienced Traders

In the competitive landscape of Gold Rush 2.0, experienced traders emphasize the importance of developing a solid strategy. Here are some key approaches to enhance your trading success:

- Research and Analysis: Understanding market trends and the underlying factors influencing asset prices is crucial. Utilize technical and fundamental analysis to make informed decisions.

- Risk Management: Successful traders always have a risk management plan in place. Set stop-loss orders to protect your investments and avoid making emotional decisions during market fluctuations.

- Diversification: Don’t put all your eggs in one basket. Diversifying your portfolio can help mitigate risks and improve your chances of successful trades.

Moreover, networking with other traders can offer valuable insights and foster mutual growth. Engaging in trading communities allows you to share experiences and learn from others' successes and mistakes. Remember, consistency is key in Gold Rush 2.0; stick to your strategy and continuously refine it based on your performance. As veteran traders often say, 'Success is a journey, not a destination'.

Is Gold Still a Safe Haven? Understanding Its Role in Today's Market Landscape

As global economic uncertainties continue to mount, many investors are left questioning, is gold still a safe haven? Historically, gold has been perceived as a reliable store of value during times of market volatility, inflation, and geopolitical tensions. Unlike fiat currencies, which can be subject to devaluation due to monetary policies, gold's intrinsic value is often viewed as a hedge against such risks. However, its performance in today's market landscape is nuanced, influenced by factors such as interest rates, currency strength, and investor sentiment. Understanding these dynamics is crucial for assessing gold's continued role in an investment portfolio.

In recent years, gold has experienced fluctuations that may lead potential investors to reconsider its status. While it generally holds up well during crises, investors must also weigh the opportunity costs associated with holding physical gold versus other assets. It's essential to examine the current market landscape, including trends in commodities, stock markets, and emerging technologies, which may pose alternative investment opportunities. Therefore, the answer to whether gold is still a safe haven is not straightforward; it demands a closer inspection of both immediate and long-term economic indicators.