Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Get More Bang for Your Buck with Auto Insurance Discounts

Unlock hidden savings! Discover how to maximize your auto insurance discounts and keep more cash in your pocket today!

Top 10 Auto Insurance Discounts You Might Be Missing Out On

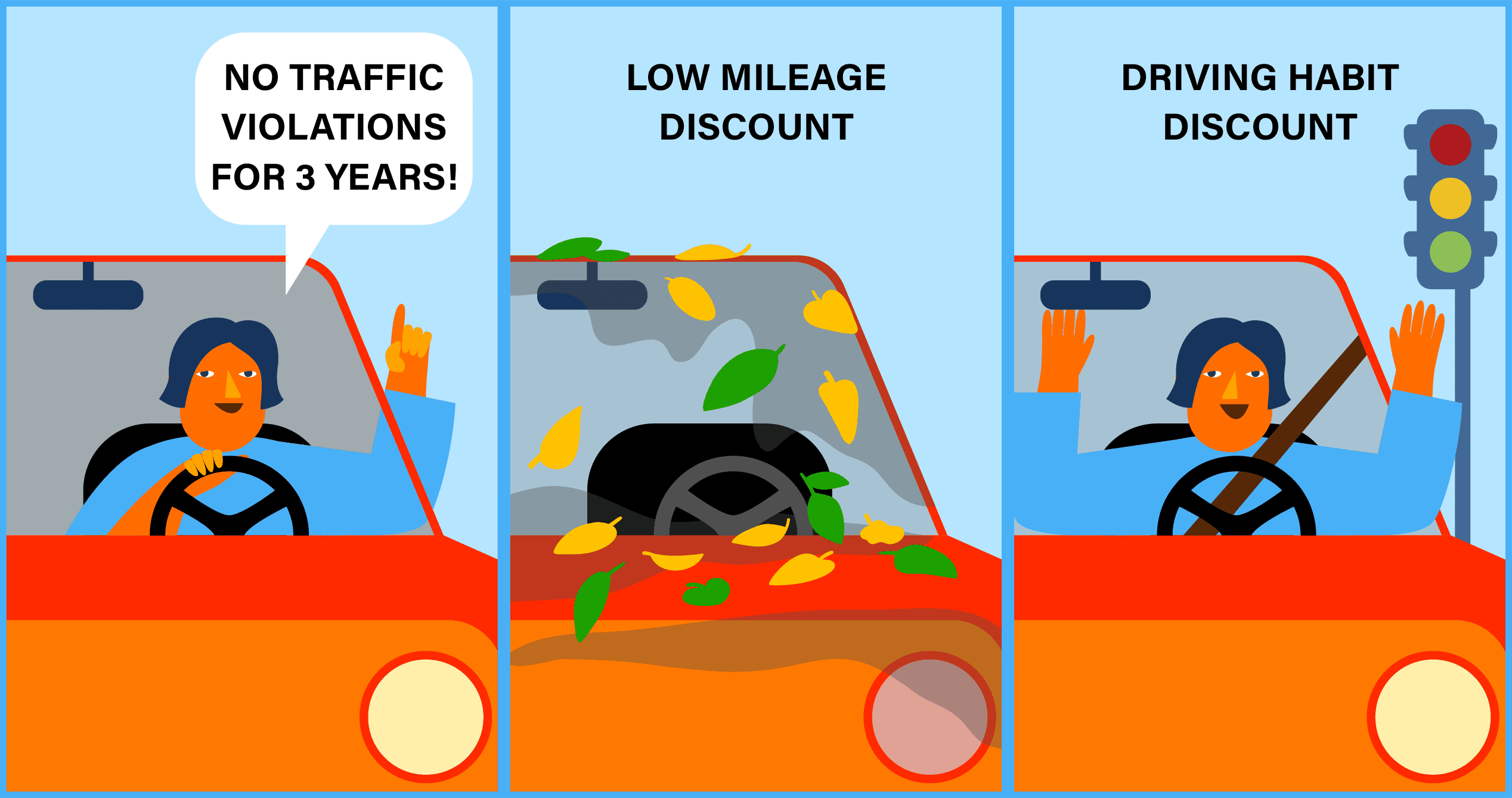

When shopping for car insurance, many drivers overlook potential auto insurance discounts that could save them a significant amount of money. From safety features to driving habits, insurers offer various ways to lower premiums. Here are the top discounts you might be missing out on:

- Multi-Policy Discount: Bundling your auto insurance with other policies, like home or renters insurance, can lead to substantial savings.

- Safe Driver Discount: Maintaining a clean driving record can qualify you for this discount, rewarding you for your responsible driving habits.

- Low Mileage Discount: If you drive less than a specific number of miles per year, you may be eligible for a discount.

- Good Student Discount: Young drivers who maintain a high GPA might qualify for this discount, encouraging academic excellence.

- Defensive Driving Course Discount: Completing an approved defensive driving course can not only improve your skills but also lower your premium.

- Vehicle Safety Features Discount: Cars equipped with safety features like anti-lock brakes and airbags may attract discounts due to reduced risk.

- Military Discount: Active duty and veterans often enjoy special auto insurance rates as a thank you for their service.

- Retiree Discount: Some companies offer discounts for senior citizens who have more time to drive safely.

- Association or Employer Discounts: Membership in certain organizations or employers can yield exclusive discounts on your insurance policy.

- Pay-in-Full Discount: Opting to pay your premium in full rather than in installments can often save you some money.

How to Maximize Your Auto Insurance Savings: A Comprehensive Guide

Finding ways to maximize your auto insurance savings is essential for getting the best value from your policy. Start by shopping around and comparing quotes from multiple insurance providers. Make sure to take advantage of any available discounts, such as savings for bundling multiple policies, having a clean driving record, or being a member of certain organizations. Additionally, consider raising your deductible, which can lower your premium. However, ensure that you can afford the out-of-pocket costs in the event of a claim.

Another effective strategy is to regularly review your coverage needs. As your life circumstances change, your insurance requirements may also shift. For example, if your vehicle is paid off, you may not need as much coverage as before. Furthermore, maintaining a good credit score can positively impact your premium rates. Overall, being proactive about your insurance policy not only helps in finding savings but also ensures you have the right coverage tailored to your current situation.

Are You Eligible? Discover Common Auto Insurance Discount Criteria

When searching for the best auto insurance rates, it's essential to consider the discount criteria that many insurance providers offer. Eligibility for these discounts can vary, but common factors include your driving history, the type of vehicle you own, and even your age. For example, safe driving records often yield significant discounts, as insurers prioritize clients who have proven responsible on the road. Additionally, if you drive a newer model with advanced safety features, you may also qualify for reduced premiums.

Other auto insurance discount criteria often include factors such as bundling policies, completing driver safety courses, or being a member of certain professional organizations. Some insurers provide rewards for low annual mileage, promoting responsible driving habits. It's important to review your specific situation and discuss with your insurance agent to ensure you are taking full advantage of the available discounts. Remember, every little bit helps when it comes to cutting costs on auto insurance!