Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Disability Insurance: The Safety Net You Didn't Know You Needed

Discover why disability insurance is the crucial safety net you never knew you needed—protect your future today!

What You Need to Know About Disability Insurance: A Comprehensive Guide

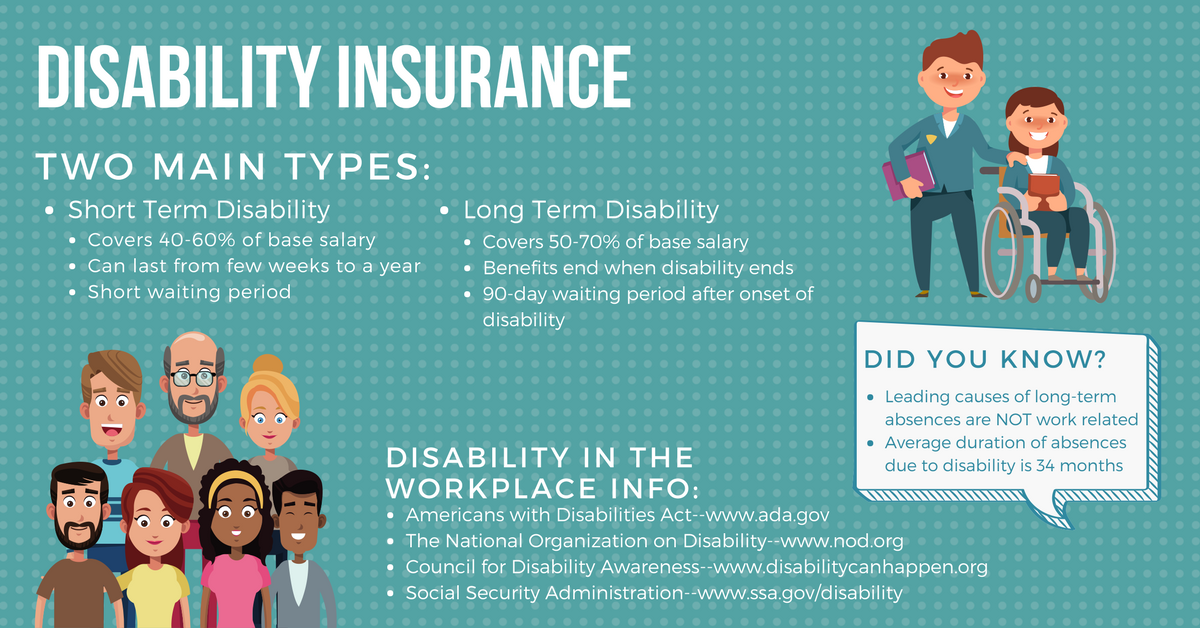

Disability insurance serves as a critical safety net for individuals who may find themselves unable to work due to illness or injury. It provides financial support, enabling policyholders to cover essential expenses, such as mortgage payments, living costs, and medical bills. Understanding the different types of disability insurance is vital. Generally, there are two main categories: short-term disability insurance, which offers benefits for a limited period, typically up to six months, and long-term disability insurance, which can provide coverage for several years or until retirement age. Each type has its own terms, waiting periods, and qualifications, making it essential to evaluate your personal needs and circumstances when choosing a policy.

When selecting a disability insurance policy, there are several factors to consider. First, assess your coverage needs based on your income and living expenses; a common recommendation is to secure a policy that replaces about 60% to 80% of your pre-disability income. Additionally, pay attention to the elimination period—the time you must be disabled before benefits kick in—as well as the benefit period, which defines how long you will receive payments. Finally, read the fine print for any exclusions or limitations that may affect your eligibility. By being informed about these key elements, you can make a confident decision that best protects your financial future should an unexpected disability arise.

5 Common Myths About Disability Insurance Debunked

Disability insurance is often misunderstood, leading to the perpetuation of several myths that can deter individuals from securing this crucial protection. One common myth is that disability insurance only covers accidents. In reality, most policies provide coverage for a variety of conditions, including illnesses like cancer or mental health disorders, that prevent an individual from working. It’s important for consumers to understand that not all disabilities stem from accidents, and having coverage can provide peace of mind during unexpected hardships.

Another prevalent myth is that disability insurance is too expensive for the average person. While it’s true that premiums can vary based on factors like age and occupation, many find that the cost is manageable, especially when considering the financial security it offers in the event of an unexpected disablement. Furthermore, some employers offer disability insurance as part of their benefits package, making it even more accessible. Understanding these facts can help dispel the notion that securing this type of insurance is out of reach for most individuals.

How Disability Insurance Can Protect Your Financial Future

In today's unpredictable world, having the right financial safety net is essential, and disability insurance serves as a crucial component in protecting your financial future. This type of insurance provides income replacement if you become unable to work due to an illness or injury, ensuring that you can maintain your living standards and meet essential expenses. Without disability insurance, the financial strain can quickly become overwhelming, leading to significant disruptions in your life.

Moreover, disability insurance not only safeguards your income but also safeguards your long-term goals. By ensuring a steady stream of income during challenging times, you can continue to save for retirement, fund your children's education, and meet other critical financial obligations. In essence, disability insurance empowers you to plan for a secure future, allowing you to face life’s uncertainties with confidence and peace of mind.