Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

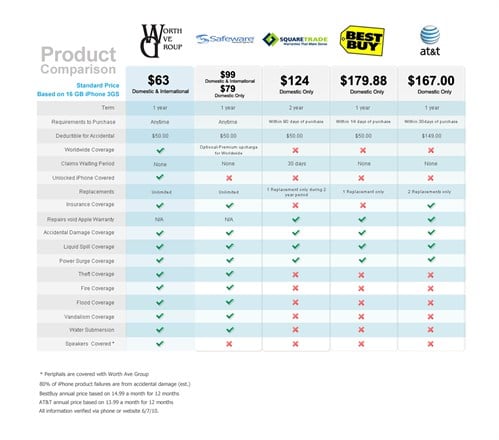

Comparing Insurance: The Secret Sauce to Saving Big Bucks

Unlock big savings! Discover the secret sauce to comparing insurance and keep more money in your pocket. Start saving today!

Top 5 Insurance Myths That Are Costing You Money

When it comes to insurance, many people operate under a series of misconceptions that can lead to financial loss. Understanding the top 5 insurance myths that are costing you money can help you make more informed decisions and potentially save thousands. One prevalent myth is that having a low deductible is always the best option. While lower deductibles mean less out-of-pocket expense during a claim, they often result in higher premium costs. Weighing your risk tolerance and financial situation is key to making the right choice for your needs.

Another common myth is that you only need insurance if you own valuable assets. In reality, insurance policies can protect against unforeseen events, including accidents or liabilities, even if you don’t own a home or car. Additionally, many people believe that shopping for insurance is pointless; they assume their current provider has the best rates. In fact, comparing quotes from multiple insurers can uncover significant savings and better coverage options. Breaking free from these myths enables informed financial choices to keep your hard-earned money where it belongs—in your wallet.

How to Choose the Right Insurance: A Step-by-Step Guide

Choosing the right insurance can seem overwhelming, but breaking it down into manageable steps can simplify the process. Start by assessing your specific needs; identify what type of insurance you require, whether it’s health, auto, home, or life insurance. Consider factors such as your lifestyle, financial responsibilities, and any legal requirements in your area. Once you have a clear understanding of your needs, gather multiple quotes to compare different policies and premiums. This not only helps you understand your options but also allows you to find the best value for your coverage.

Next, it’s essential to evaluate the insurers themselves. Look for companies with strong financial ratings, excellent customer service reviews, and a history of paying out claims. Research their reputation by checking reliable reviews or asking for recommendations. You may want to formulate a list of questions to address with potential insurers, such as their claims process and any available discounts. Finally, read the fine print on any policy you consider to ensure you fully understand the coverage, exclusions, and terms. By following these steps, you can choose the right insurance that aligns with your needs and provides peace of mind.

Are You Overpaying? Key Questions to Ask Your Insurance Provider

When it comes to your insurance coverage, being informed can significantly impact your monthly premiums. Start by asking your insurance provider about the specifics of your policy. Questions like, "What factors contribute to my premium amount?" and "Are there any discounts available that I might qualify for?" can provide valuable insights. Additionally, inquire whether your policy covers all of your needs or if there are unnecessary extras that are inflating your costs. Understanding the full scope of your coverage is essential to determining if you're possibly overpaying.

Another important aspect to consider is comparing your policy with similar options in the market. Ask your insurance provider, "How does my policy compare with others in terms of cost and coverage?" This can help you gauge whether you're getting a competitive rate or if there are more affordable alternatives. Furthermore, don’t hesitate to discuss any life changes that may have occurred since you first signed up for the policy. Events such as moving to a new location or upgrading your car can affect your rate. Being proactive and regularly evaluating your insurance will help ensure that you’re not spending more than necessary.