Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Cheap Insurance: Saving Big Without Sacrificing Coverage

Discover savvy tips to score affordable insurance while keeping top-notch coverage. Save big without compromise today!

Understanding the Key Factors for Affordable Insurance

Understanding the key factors for affordable insurance involves evaluating several crucial elements that can significantly impact your premiums. One of the primary considerations is coverage type. Different policies offer varying levels of protection, from basic liability coverage to comprehensive plans. Understanding what you truly need can prevent you from overpaying for unnecessary extras. Additionally, shopping around for quotes from multiple insurers allows you to compare rates and identify potential savings. Don't forget to inquire about available discounts, which can further enhance the affordability of your insurance.

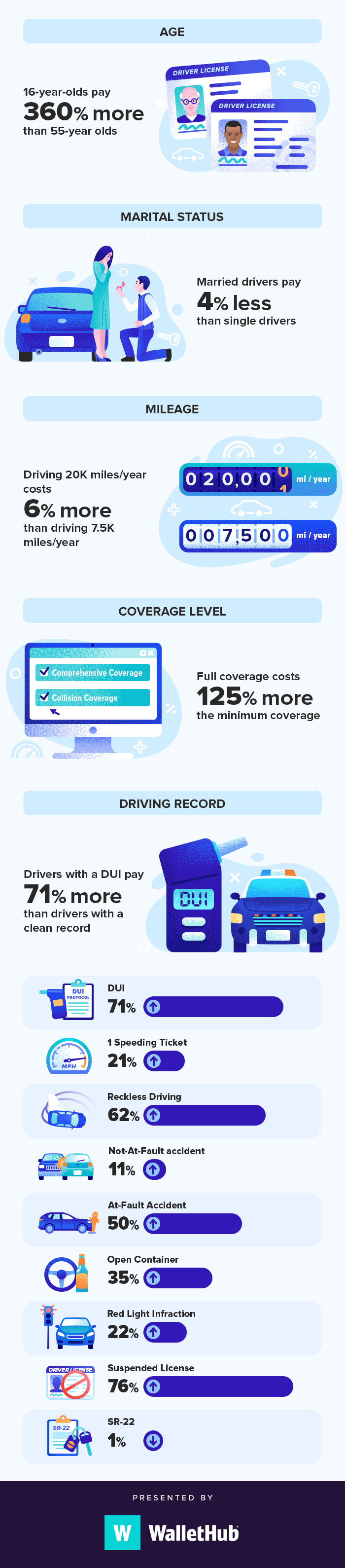

Another vital factor in achieving affordable insurance is your credit score. Insurers often use credit scores to determine risk levels, with lower scores potentially leading to higher premiums. Maintaining a good credit score through responsible financial habits can help you secure better rates. Additionally, factors such as your location, driving record, and even the type of vehicle you own can influence pricing. By being aware of these elements and taking steps to improve your risk profile, you can create a tailored strategy to obtain affordable insurance tailored to your needs.

How to Compare Insurance Policies Without Sacrificing Coverage

When it comes to comparing insurance policies, it's crucial to focus on key factors to ensure that you don't sacrifice essential coverage. Start by identifying the types of coverage you need—whether it's health, auto, or home insurance. Create a checklist of must-have features to guide your comparison. For example, consider the coverage limits, deductibles, and exclusions. This systematic approach will help you maintain a clear overview of what each policy offers without feeling overwhelmed.

Moreover, utilize comparison tools and resources that allow you to evaluate policies side by side. Pay attention to customer reviews and ratings that reflect real-life experiences. While price is a significant factor, ensure that you also assess the claims process and customer service quality. By analyzing these aspects, you can find a policy that provides both affordability and comprehensive coverage, ensuring that you protect your assets adequately.

Top 10 Tips for Finding Cheap Insurance That Meets Your Needs

Finding cheap insurance that meets your needs can be a daunting task, but with the right approach, it can be manageable. Start by assessing your coverage requirements. Understanding what kind of insurance you need—whether it's auto, home, or health insurance—will help you focus your search. Once you have clarity on your needs, shop around. Compare quotes from multiple providers to see which ones offer plans that fit your budget without sacrificing necessary coverage.

Next, consider factors like your deductibles and the insurance provider's reputation. Choosing a higher deductible can lower your premium, but ensure you can afford the out-of-pocket expense in case of a claim. Additionally, take advantage of discounts that insurance companies frequently offer, such as bundle discounts for multiple policies or safe driver discounts. Use these tips to narrow down your options and secure the best rates without compromising on the coverage you need.