Shop At Haya: Your Ultimate Shopping Guide

Discover the best shopping tips, trends, and deals for a smarter buying experience.

Forex Frenzy: Riding the Waves of Currency Chaos

Dive into Forex Frenzy and uncover strategies to conquer currency chaos—maximize your profits and ride the waves of trading success!

Understanding Forex Market Basics: A Beginner's Guide

The Forex market, or foreign exchange market, is the largest and most liquid financial market in the world, where currencies are traded. Understanding the basics of this market is crucial for any beginner who wants to venture into currency trading. Unlike stock markets that have specific trading hours, the Forex market operates 24 hours a day, five days a week, allowing traders to participate at their convenience. This market facilitates the conversion of one currency into another and is influenced by various factors, including economic indicators, interest rates, and geopolitical events.

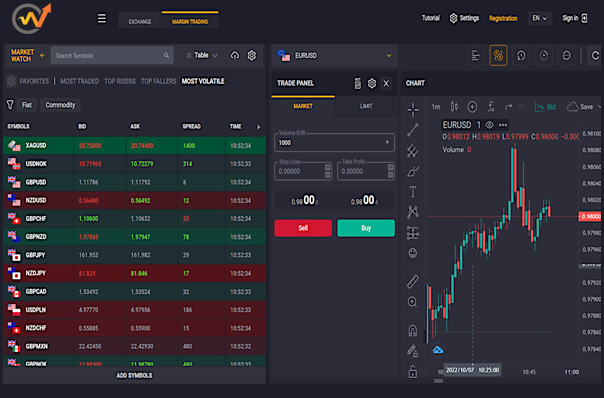

To start trading in the Forex market, one must grasp key concepts such as currency pairs, where two currencies are quoted against each other (e.g., EUR/USD). It is essential to understand terms like pips (the smallest price move that a given exchange rate can make), leverage (using borrowed funds to increase potential returns), and spread (the difference between buying and selling prices). New traders should consider practicing with demo accounts to hone their skills without financial risk, allowing them to build confidence before entering the live market.

Top Strategies for Navigating Currency Fluctuations

Navigating currency fluctuations can be challenging, but employing the right strategies can help you mitigate risks and enhance your financial outcomes. One effective approach is to diversify your investments. By spreading your assets across various currencies and regions, you can reduce the impact of adverse currency movements on your portfolio. Moreover, consider using hedging techniques, such as forward contracts or options, to lock in exchange rates for future transactions, providing a safety net against unpredictable currency shifts.

Another vital strategy is to stay informed about global economic indicators that influence currency values. Key metrics such as interest rates, inflation rates, and political stability can provide insights into potential currency trends. Additionally, employing a dynamic pricing strategy can help businesses adjust their prices promptly in response to currency fluctuations, ensuring competitiveness in the market while protecting profit margins. By implementing these strategies, you can effectively navigate the complexities of currency fluctuations and secure your financial interests.

What Causes Currency Chaos? Key Factors Influencing Forex Markets

The world of forex markets is often turbulent, influenced by a myriad of factors that can lead to significant currency chaos. One of the primary factors is economic indicators, which include inflation rates, unemployment rates, and GDP growth. These indicators offer insights into a country's economic health and can trigger market volatility when released unexpectedly. Another critical element is geopolitical events, such as elections, trade wars, and international conflicts. Such events can create uncertainty, prompting investors to rethink their positions and consequently leading to sharp fluctuations in currency valuations.

Furthermore, central bank policies play an instrumental role in shaping forex markets. Decisions on interest rates and quantitative easing can either stabilize or destabilize currencies, depending on market perceptions. Additionally, market sentiment and speculation also contribute to currency chaos. Traders often react emotionally to news and rumors, causing ripple effects that can result in rapid price changes. Understanding these key factors is essential for anyone looking to navigate the complexities of currency markets effectively.